Mid-market Fintech Company

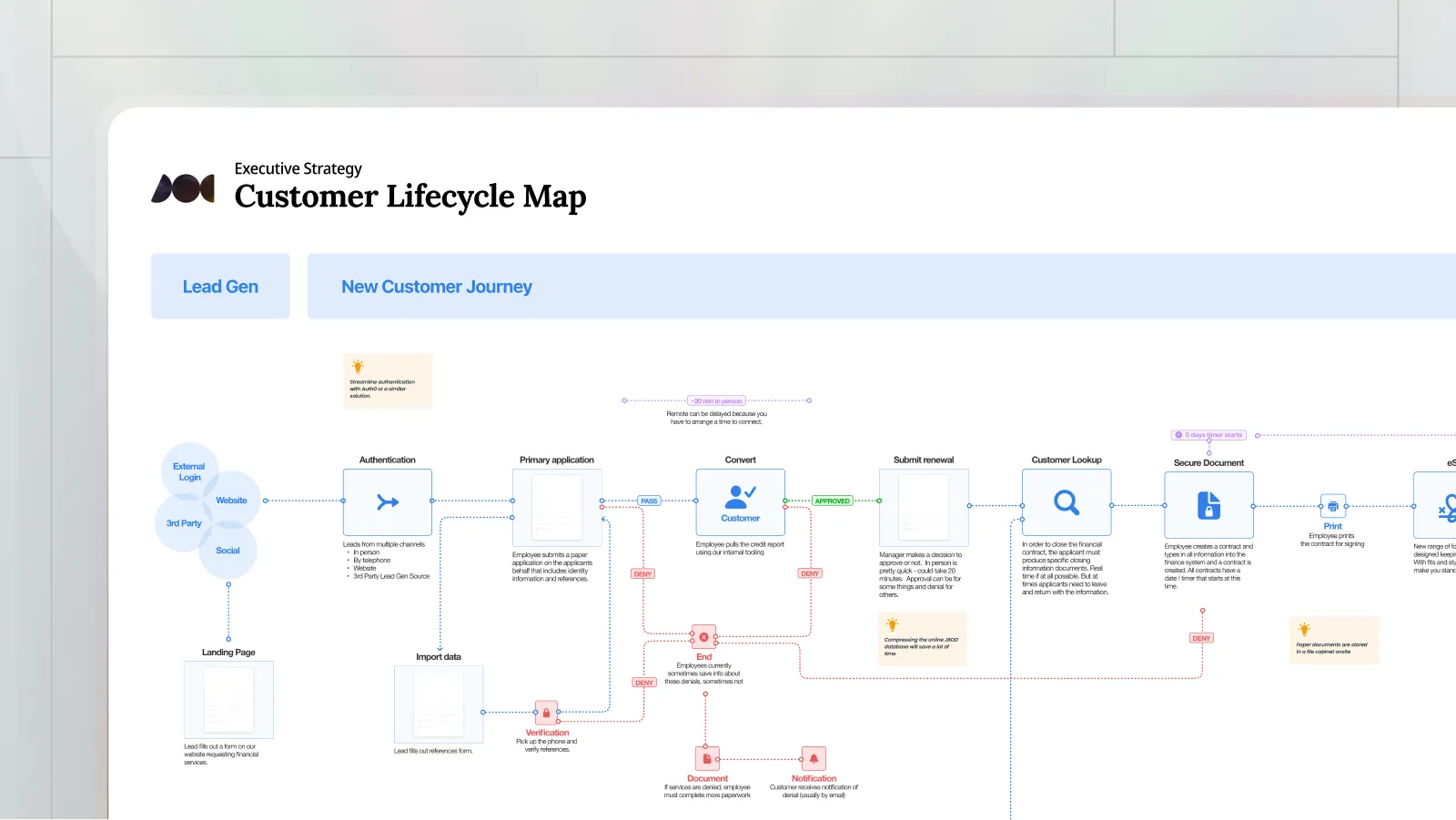

I was brought in to help a growing financial services company transform into a modern fintech company. Transitioning from outdated, paper-based systems and disconnected data across multiple franchise locations to operating like a modern product company was no small task.

This wasn’t just a design facelift. It was an organizational shift.

A Myriad of Challenges

The company was battling archaic and disconnected systems, non-existent design and dev op processes, paper-centric operations, and escalating costs for external data requests. Employees struggled with fragmented tooling, long wait times for updates, lack of a unified interface, and redundant workflows. Meanwhile, onboarding new staff was a costly, time-consuming process, slowing their ability to scale.

The Strategy

I led the charge across four fronts in collaboration with Peter Unsworth, a deeply experienced technical leader.

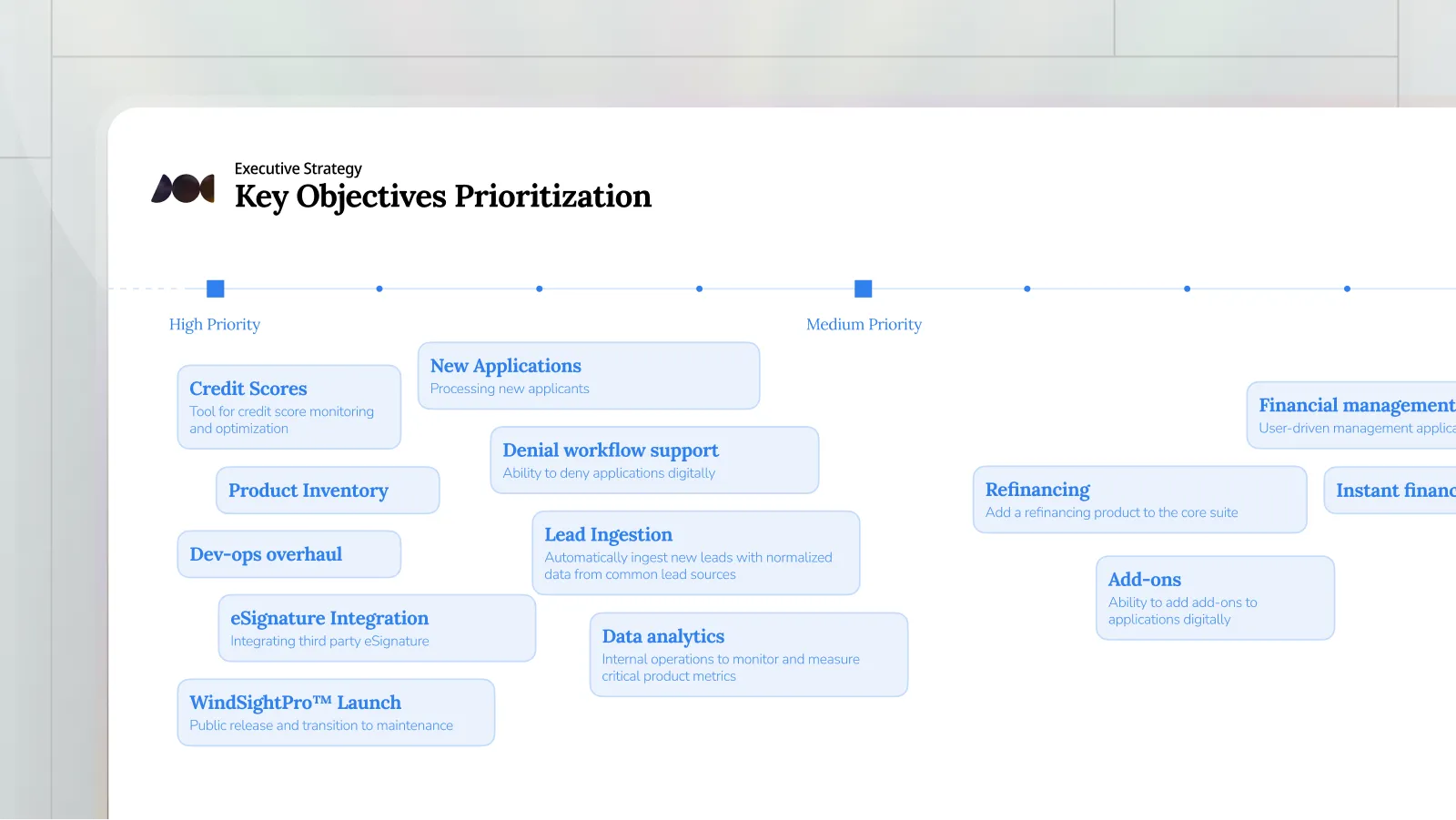

Executive Strategy: Collaborated across ops, dev, front-of-house, and leadership to align on a singular product vision and a plan to modernize the company product delivery operations to bring it to life.

Operational Overhaul: Instituted structured product planning, design-ops, and dev-ops with a focus on user feedback and iterative learnings through phased releases. Rolled out and enforced the new operational model over the course of a year to get the entire business aligned and moving in sync.

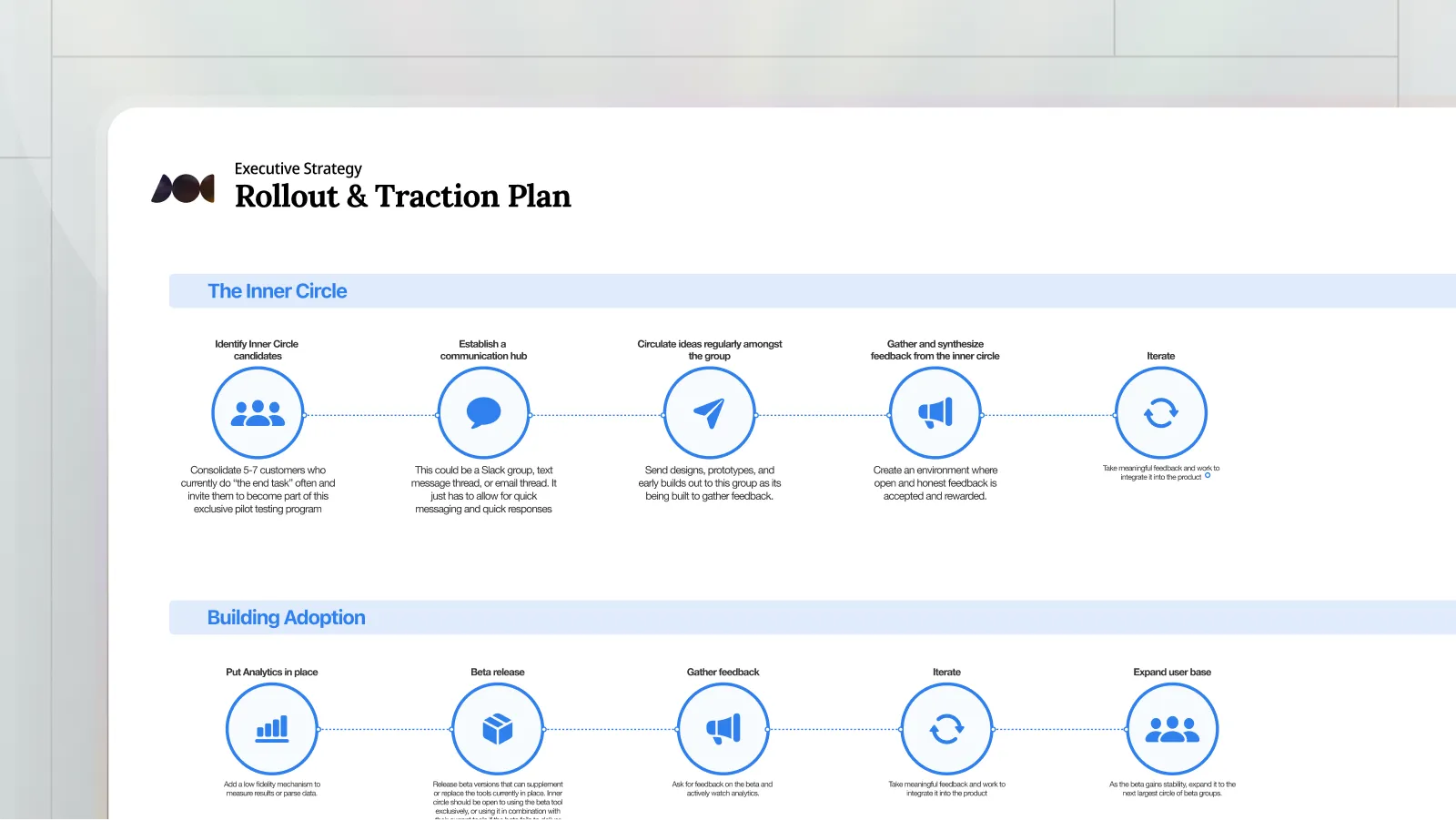

Product Releases & Traction: Worked with the development team and business to build and roll out the products on a new scalable app architecture in a phased manner (developers → team → inner-circle → private beta → public), which would serve as the foundation for all delivering future internal tools, unifying experience, reducing tech debt, and supporting data governance.

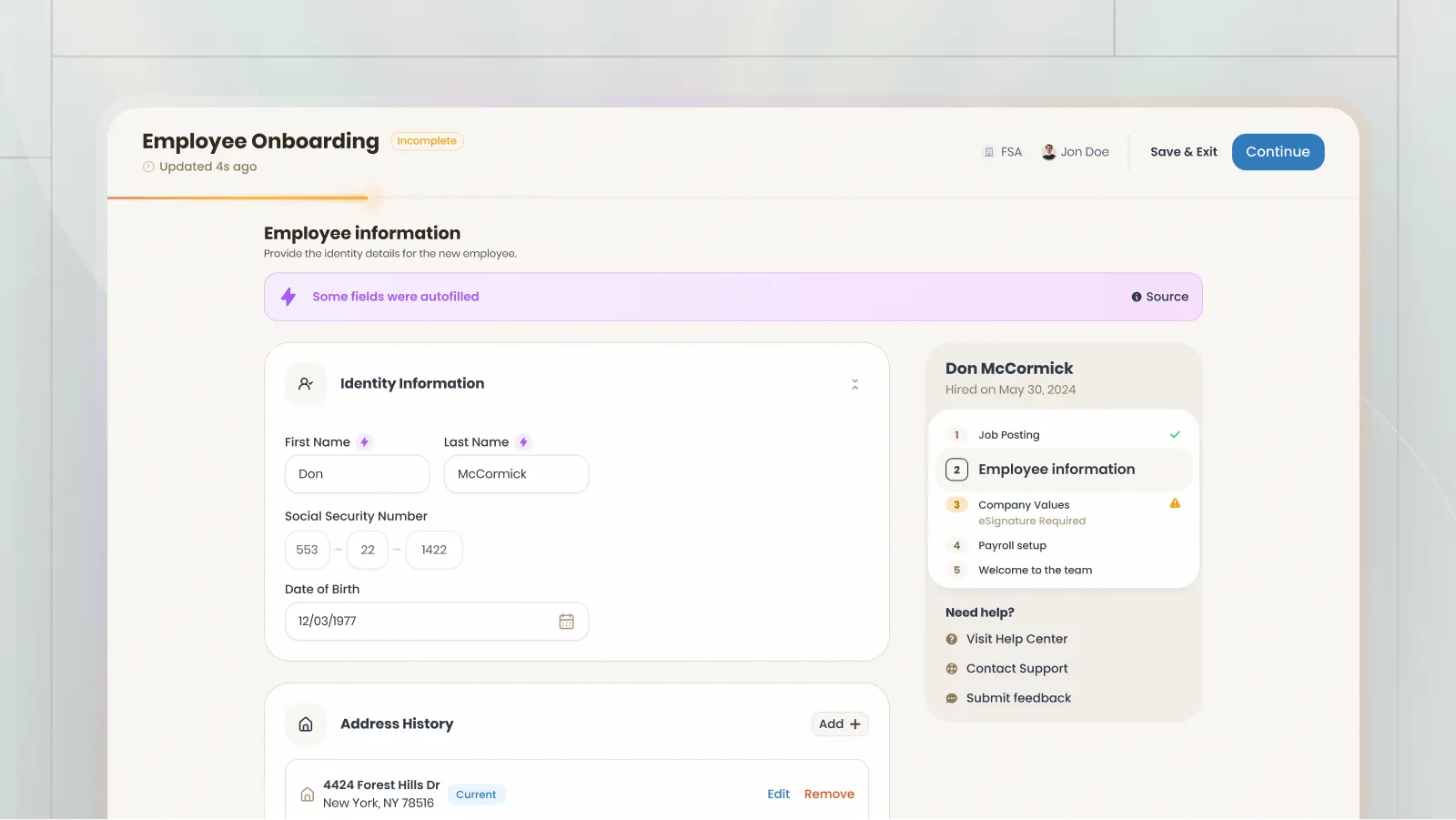

Product Design: Implemented a design system and designed a suite of products within that system. Designs were focused on reducing manual entry, reducing training costs, and designed to integrate easily with existing infrastructure limitations.

The Execution

I bridged strategy and execution – my role was end-to-end. I not only shaped the strategic direction but also executed with precision; translating insight into pixels, pixels into adoption, and adoption into measurable business impact.

- Aligned executives around their core value streams and vision

- Established lean product operations in Jira

- Established design-ops and dev-ops workflows

- Built teams around these new processes and worked to build alignment

- Instituted a design system

- Created a feedback driven culture to accelerate iteration and adoption (establishing inner circles and beta testing groups)

- Led design of an application management software

- Deprecated old paper-processes and data filing and transitioned to new software stack

We designed a Linux-friendly desktop app that authenticated with the company’s user directory and allowed agents to securely retrieve third-party data (like TransUnion credit reports) with one click. Data freshness indicators and offline persistence reduced redundant calls and costs. The app became a model for modern GUI within the org, an MVP that also served as a blueprint for future internal apps.

The Outcome

The wins from this work were too many to count. By the end of our partnership, it was a completely different company. Their ability to strategize, build, and release software, and gain adoption around it looked nothing like the heavily manual, paper-driven, slowly-delivering company that we started with. Here are just a few of the highlights:

- Established a long term product vision

- Rolled out and secured full team adoption of new operational model for design and dev

- Replaced costly print material SOPs with new software

- Reduced manual entry errors

- Integrated multiple third party tools and significantly reduced costs on those partnerships through smart data retention policies

- Substantially reduced employee training and retraining costs

- Minimized external data retrieval costs

- Increased new feature adoption and reduced internal ops chaos by securing user buy-in early and often via our phased beta rollout strategy

- Created a shared design language and application model across teams

- Established a scalable architecture for future applications

This was more than just a software redesign. It was a leap forward in operational efficiency, data management, and strategic clarity, unlocking a new future for how this business built software.